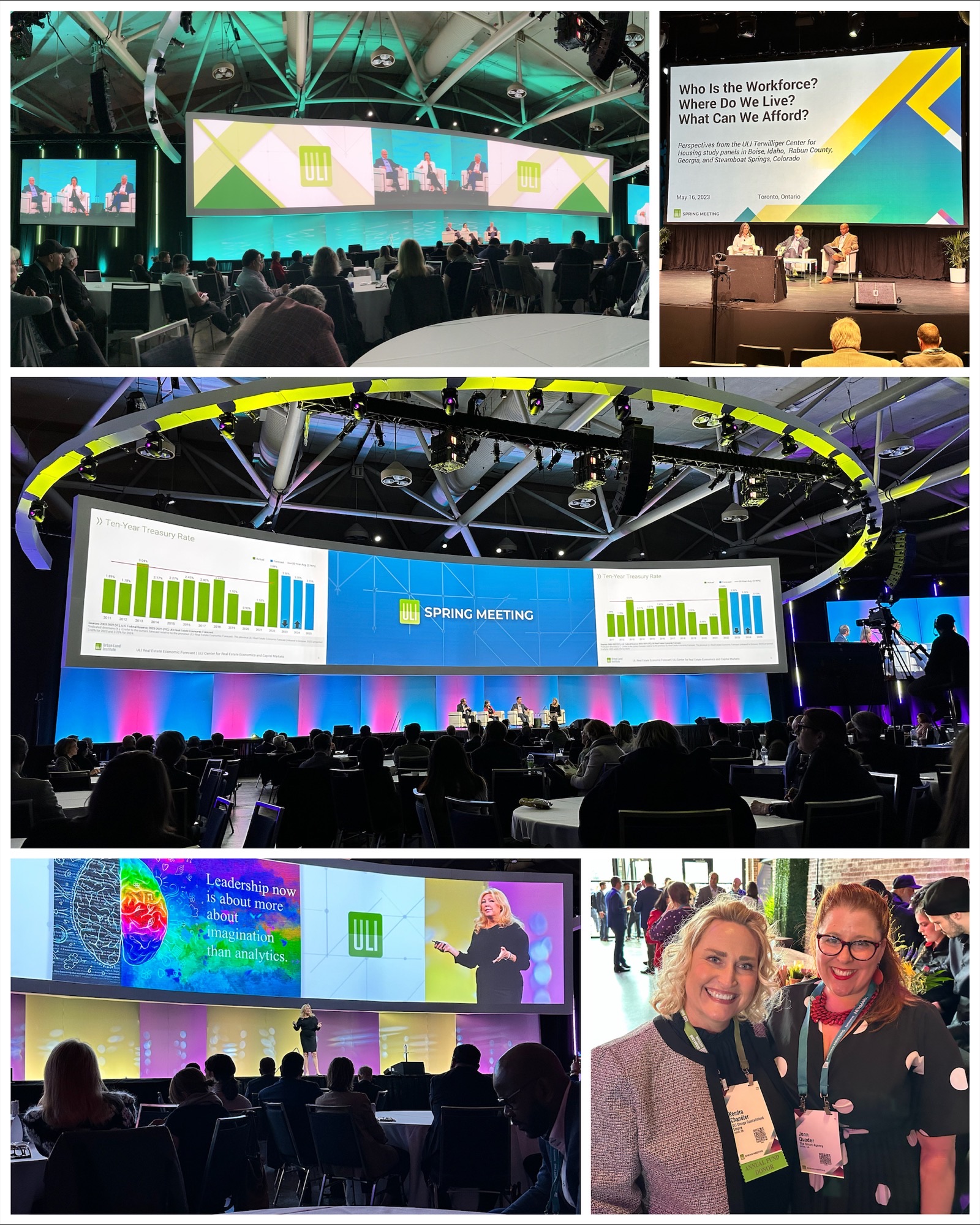

#ULISpring is underway, and opportunity abounds.

More than 4,000 attendees on the cutting edge of #Sustainability, #Decarbonization, #HousingEquity, and #Education have gathered for imaginative conversations that reveal a clear theme:

“Now is the time to turn challenges into opportunities for resilient and transformative growth in #CommercialRealEstate.”

—Ron Pressman, Global CEO of Urban Land Institute

But how?

Some key takeaways below:

“We are at the beginning of the next upturn. The key is to advance the areas that are going to grow.”

—Diane Hoskins, Co-CEO Gensler

“We have reached a once-in-a-species moment. Data-driven geopolitical conflicts, the race toward space-based solar power, and the digitization of money are poised to make today’s leaders prioritize imagination even more than analysis.”

—Dr Pippa Malmgren

#ModerateIncomeHousing Workforce Panel:

“We can’t recruit doctors and nurses to this region because we can’t pay them enough for housing costs.” // “We couldn’t get a school superintendent to move to our community because they couldn’t afford housing.”

These quotes reveal the true local impact of America’s ever-rising #AffordableHousing demand.

ULI Advisory Services and TAP programs are igniting conversations in many communities, helping them to collaborate regionally, build alignment between zoning needs and housing plans, educate on different housing typologies, and create sustainable plans to tackle this immediate need.

#PropTech Panel:

“Listen to the data! Companies like Amazon, Target, and Disney know more about your residents/tenants than you. How can you get granular data that fuels better operational decisions? Centralize your own data, then implement strategic tech solutions to make that data digestible and actionable.”

#CapitalMarkets Panel:

“Overall, there is less capital to work with and less urgency to deploy it. And yet, many investors are finding high-quality assets in markets they weren’t able to get into before.”

RETAIL: spread is widening.

INDUSTRIAL: Logistics properties have had a great run with astronomical rent growth.

OFFICE: There is some mis-pricing; However, it’s a lot about emotion.

“I think we should let go of that emotion and simply focus on: what is a good location today? What does quality mean today?”

Demand is strong for Grade A, high-quality, energy-efficient office properties near services, amenities, technology, and hospitality. Operators who can create this value at the property level will be able to achieve better NOI.

MULTIFAMILY: People are moving in search of affordability, and growth is begetting growth, especially across the U.S. Sunbelt.

OPPORTUNITIES: “It turns out data it is physical and has to land somewhere (i.e. data centers). Generative AI will grow these needs. We are also seeing growth in life science and biomedical research.”

#EconomicForecast Panel:

“We are in a lending crunch as opposed to crisis. Yes, it is tougher to get a loan, and more expensive. CRE volumes are expected to go down and return around 2025.”

“Capital markets are focused on the product types, locations and sectors that will help offset what is believed to be an upcoming mild recession.”

“Debt has become cool again.”

“If we experience a property market recession, that may in fact create some balance by re-opening the capital markets into more dealflow.”

“We have reached ‘peak pessimism’ on office. But in many ways, it mirrors the retail sentiment of several years ago. As an industry, we gave up ‘too much’ on retail. The same is happening in office, where in truth, a lot of the negative hits have already been taken.”

“Retail vacancy is its lowest since 2007, and rents are growing.“

“Industrial has experienced phenomenal rent growth, and will continue to be bolstered by e-commerce and on-shoring/near-shoring. Challenges include land availability and pressure from regulatory issues.”

“Multifamily will face new supply coming online, as well as affordability constraints that could bring the ability to raise rents to a threshold. That said, we will come out of this downturn with the same housing needs we still have, meaning demand will remain very high.”

—-

Overall, a tremendous experience thus far! Thank you to the wonderful people of ULI.

See y’all tomorrow!

#UrbanLandInstitute #Takeaways #CommercialRealEstateInvestment #InstitutionalInvestment #GlobalRealEstateTrends